south dakota property taxes by county

See How Much You. Please allow 7-10 business days to process if paying online.

South Dakota Property Tax Calculator Smartasset

The assessed value is based on the market value or what the value of the property is actually worth.

. 128 of home value. SDCL 10-24 In South Dakota property owners have a period of time during which they can repurchase redeem their property by paying the amount owed. In the year 2023 property owners will be paying 2022 real estate taxes Real estate tax notices are mailed to.

1110 of Assessed Home Value. Click here for any questions about tax. Hamlin County Treasurer PO Box 267.

Dakota County Treasurer-Auditor 1590 Highway 55 Hastings MN 55033 651-438-4576 Fax 651-438-4399 wwwdakotacountyus. Please click HERE to go to payview your property taxes. The Minnehaha County Treasurers Office seeks to provide taxpayers with the best possible services to meet the continued and growing needs of Minnehaha County.

14 hours agoReal Property address. This data is based on a 5-year study of median property tax. 1290 of Assessed Home Value.

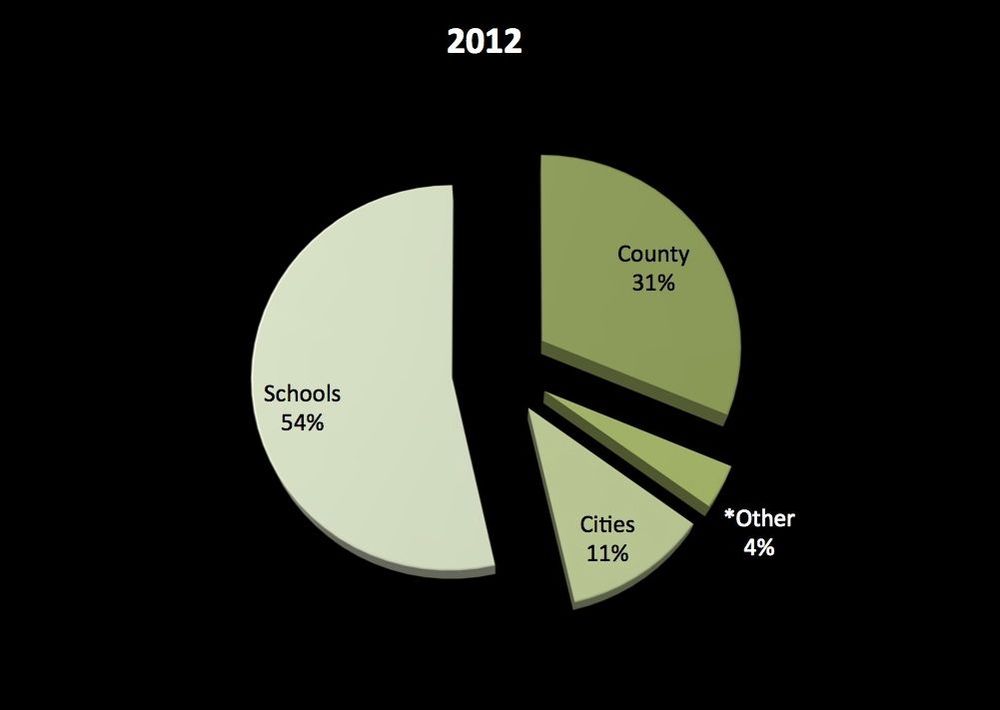

1250 of Assessed Home Value. Spink County Redfield South Dakota. The Treasurer is not only responsible for collecting property taxes for the county but the city and school districts as well.

POLLING PLACES FOR NOVEMBER 8th 2022 GENERAL ELECTION. SOUTH SAINT PAUL MN 55075. ViewPay Property Taxes Online.

This is determined by comparing the property to be assessed with the selling price of. Public Property Records provide information on land homes and commercial properties. Property taxes are due October 31st.

Tax amount varies by county. To find detailed property tax statistics for any county in South Dakota click the countys name in the data table above. 671 Park Street Dickinson ND 58601 The above real property is the subject of the Mortgage dated December 11 2018 which Mortgagors Brandy L.

Strong Tax Collection Figures at 2022 South Dakota State Fair. Redemption from Tax Sales. A South Dakota Property Records Search locates real estate documents related to property in SD.

If you are a senior citizen or disabled citizen property tax relief applications are available through. Real estate taxes are paid one year in arrears. Tax collections from the 2022 South Dakota State Fair are at 24302683 according to figures released by the.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Spink County Government Redfield SD 57469 Home. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County.

Then the property is equalized to 85 for property tax purposes. If the county is at 100 of full and true value then the equalization factor the number to get to 85 of taxable value would. The description of the property set forth in the mortgage is that set forth above.

In-depth content for South Dakota County Auditors on calculating growth percentage CPI Relief Programs TIF and other property tax essentials. Motor vehicle fees and wheel taxes are also collected. Chief Deputy Sheriff of Davison County South Dakota Published twice at the total approximate.

State Summary Tax Assessors. Precint-1 Ethan Finance Office. SDCL 10-18A-1 to 10-18A-7 states that certain low income property owners are eligible for a property tax refund and should check with their county treasurer for details and assistance in.

Hayti South Dakota 57241-0267.

Map Of Lincoln County South Dakota Compiled And Drawn From Official Records And A Special Survey Library Of Congress

Equalization Lawrence County Sd

South Dakota Taxes Sd State Income Tax Calculator Community Tax

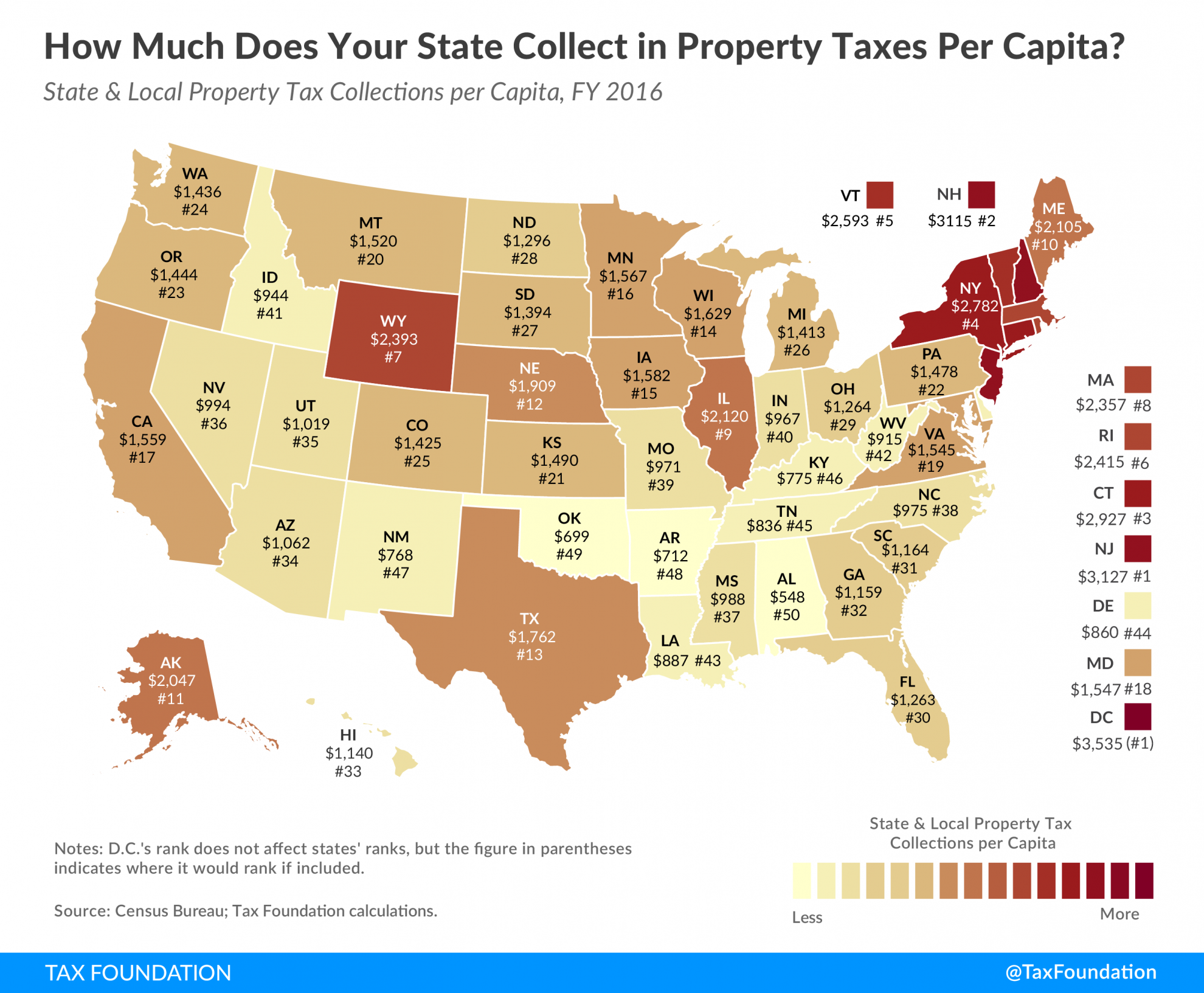

Property Taxes Per Capita State And Local Property Tax Collections

Growing Number Of State Sales Tax Jurisdictions Makes South Dakota V Wayfair That Much More Imperative Tax Foundation

Taxes Public Notices County Of Meade

South Dakota Property Tax Appeals Important Dates Savage Browning

/cloudfront-us-east-1.images.arcpublishing.com/gray/BNBTRKY7OBHHPLJJKLATCOBCZM.JPG)

Sioux Falls Residents Could Face 3 Property Tax Increase In 2023

Property Tax Comparison By State How Does Your State Compare

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Understanding Your Property Tax Statement Cass County Nd

Historical South Dakota Tax Policy Information Ballotpedia

States With No Income Tax Explained Dakotapost

Property Taxes By County Interactive Map Tax Foundation

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

How High Are Property Taxes In Your State Tax Foundation